Sales Tax Rate For Vancouver Wa – Whether buying or selling, the process requires careful consideration, transparent communication, and a thorough understanding of both the financial and operational aspects of the business. A home is more than just walls and a roof; it’s where memories are made, where families grow, and where life unfolds. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. Similarly, a quality suit made from fine wool will age gracefully, developing a patina that speaks to its craftsmanship. Quality goods for sale are not just limited to luxury items or high-end brands. But in reality, even the most profound relationships can be commodified in some way. For the seller, the goal is often to maximize the value of the business, which requires a clear understanding of the company’s assets, liabilities, and future earning potential. Influencers sell their attention, their opinions, their lives — all of it has become a form of commerce. A business for sale is not always as it appears on the surface, and the buyer must examine the company’s financial statements, contracts, debts, and even its customer relationships before deciding whether to proceed with the transaction. The act of selling a home is a deeply emotional process, and when it’s completed, there’s a sense of closure and anticipation for what comes next. For many people, there is something uniquely satisfying about sifting through racks of clothes, rummaging through bins of books, or browsing shelves of home goods in search of that perfect item. Whether it’s vintage clothing, antique furniture, or used luxury watches, second-hand goods offer an opportunity for buyers to find quality items that are no longer available in stores. To mitigate this risk, buyers should ask for detailed photos, read product descriptions carefully, and inquire about the condition of the item before making a purchase. The idea that everything is for sale works to perpetuate inequality, as those with the most resources can continue to amass power and wealth, while others are left to scramble for what little they can get. Relationships can become transactional, where each party enters into an agreement based on what they stand to gain. Online platforms also offer the convenience of searching for specific items, whether it’s a rare collector’s item, a particular brand of clothing, or a piece of furniture that fits a specific design style. But is this a reflection of reality? Or is it an illusion we’ve created, an idea we’ve accepted in order to make sense of a world that increasingly revolves around consumption and profit?

At the core of this idea lies the assumption that everything, no matter how unique or rare, can be exchanged. For environmentally conscious consumers, buying second-hand is not just a cost-effective choice, but a way to make a positive contribution to the planet. Both buyers and sellers should approach transactions with honesty and transparency to ensure a smooth exchange. Books, records, and collectibles are also highly sought after in the second-hand market.

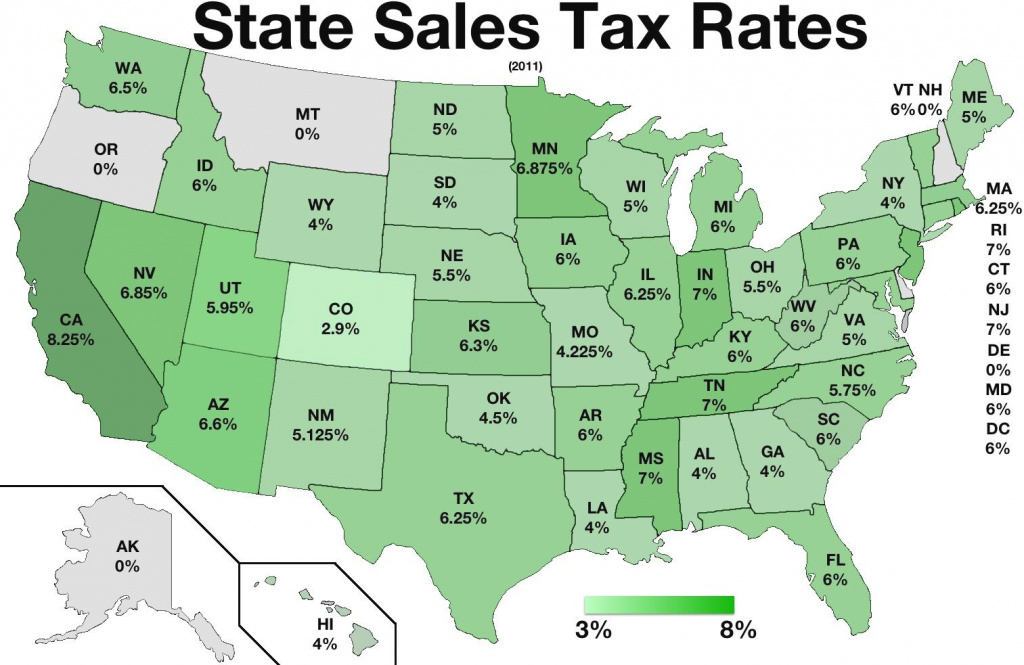

Sales Tax By State Chart

Vancouver sales tax rate is 8.70% the total sales tax rate in vancouver comprises the washington state tax and the city, which imposes an additional sales tax of 2.20%. The combined rate used in this calculator (8.7%) is the result of the washington state rate (6.5%), the vancouver tax rate. You’ll find rates for sales and use tax, motor vehicle.

Vancouver Wa Sales Tax 2025 Emmi Jerrie

This rate includes any state, county, city, and local sales taxes. It is 1.20% higher than the lowest sales tax rate. The state of washington has a general sales tax rate of 6.5% which. Search by address, zip plus four, or use the map to find the rate for a specific location. Print out a free 8.7% sales tax table.

Total Sales Tax Rate Washington 2024 Jonie Magdaia

The washington sales tax rate is currently 6.5%. The sales tax rate in vancouver, washington is 8.7%. The 98683, vancouver, washington, general sales tax rate is 8.7%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. With sales taxes charged on those products, the costs are even higher for struggling washington.

Washington's combined statelocal sales tax rate ranks 5th in the

The washington sales tax rate is currently 6.5%. 2020 rates included for use while preparing your income tax. There are a total of 178 local tax jurisdictions across the. Motor vehicle fund rcw 46.17.120 rcw 46.68.020: The vancouver, washington sales tax is 8.40%, consisting of 6.50% washington state sales tax and 1.90% vancouver local sales taxes.the local sales tax consists.

Sales Tax In Washington State 2024 Caron Cristie

You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax. This figure is the sum of the rates together on the state, county, city, and special levels. Motor vehicle fund rcw 46.17.120 rcw 46.68.020: 535 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up.

Wa State Sales Tax Calculator 2024 Darci Elonore

What is the sales tax in vancouver? Search by address, zip plus four, or use the map to find the rate for a specific location. The current sales tax rate in vancouver, wa is 8.7%. The vancouver, washington sales tax is 8.40%, consisting of 6.50% washington state sales tax and 1.90% vancouver local sales taxes.the local sales tax consists of.

Ultimate Washington Sales Tax Guide Zamp

This rate includes any state, county, city, and local sales taxes. The combined rate used in this calculator (8.7%) is the result of the washington state rate (6.5%), the vancouver tax rate. This is the total of state, county, and city sales tax rates. The washington sales tax rate is currently 6.5%. For a breakdown of rates in greater detail,.

Wa State Sales Tax 2025 Sonja Eleonore

2020 rates included for use while preparing your income tax. The current sales tax rate in 98665, wa is. The latest sales tax rate for vancouver, wa. Motor vehicle fund rcw 46.17.120 rcw 46.68.020: The combined rate used in this calculator (8.7%) is the result of the washington state rate (6.5%), the vancouver tax rate.

Wa State Sales Tax Calculator 2024 Darci Elonore

Essential baby products, including diapers, are expensive. The current sales tax rate in 98665, wa is. The 98683, vancouver, washington, general sales tax rate is 8.7%. This rate includes any state, county, city, and local sales taxes. For a breakdown of rates in greater detail, please.

Vancouver Sales Tax Rate 2024 Otha Noellyn

The latest sales tax rate for vancouver, wa. The current sales tax rate in 98665, wa is. Essential baby products, including diapers, are expensive. Search by address, zip plus four, or use the map to find the rate for a specific location. With sales taxes charged on those products, the costs are even higher for struggling washington parents.

But what about the intangible things? Can memories be bought? Can feelings, emotions, or connections be traded? In a sense, many people would argue that in today’s world, even the intangible is up for grabs. In some cases, buyers may also acquire businesses with existing intellectual property, such as patents, trademarks, or proprietary technologies, which can offer a competitive edge in the market. It’s about change, opportunity, and the negotiation of value. Thrift stores, estate sales, and online marketplaces are excellent places to find second-hand furniture, with options ranging from antique and vintage pieces to more contemporary items. Historically, many products were made by local craftsmen, and there was a direct relationship between the creator and the consumer. People place their belongings for sale for many reasons. These concepts, they say, are too sacred, too important to be reduced to mere transactions. This sense of connection can also extend to the broader culture of quality goods, where consumers and creators share a commitment to excellence and a desire to preserve the craft and tradition behind these products. Yet, at the same time, there’s the promise of new beginnings for both the seller and the buyer. Second-hand markets also promote the idea of a circular economy, an economic system that focuses on reducing waste and reusing products. The struggle is not in resisting the marketplace entirely, but in finding balance, in ensuring that the things that truly matter cannot be bought, sold, or traded. When a car is put up for sale, it can feel like letting go of a part of one’s journey. This sense of history and individuality is part of what makes second-hand shopping so appealing. People often feel like they are for sale, too, in various ways. The adage “you get what you pay for” rings especially true in the realm of quality goods. It is subjective, shaped by cultural norms, individual preferences, and the evolving standards of various industries. Take, for example, a high-quality piece of furniture — a well-crafted sofa or dining table can last for decades if maintained properly. This shift in mindset has contributed to a growing acceptance and even celebration of second-hand shopping, making it a mainstream activity that is not just about saving money but about making more thoughtful and responsible choices. Upcycling is a great way to make the most out of second-hand goods, adding both value and meaning to the items that are being repurposed. These platforms allow buyers to browse listings, access detailed business profiles, and initiate contact with sellers, all from the comfort of their own home.

The focus on longevity and reliability is what sets these goods apart from their mass-market counterparts. The notion suggests a world where anything and everything, regardless of its intrinsic value, can be bought, sold, or traded. Whether it’s funding education, supporting homelessness services, or providing medical assistance, the money spent in second-hand shops can contribute to making a difference in the lives of others. The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true. Conversely, periods of economic growth may lead to more businesses being sold due to increased valuations and higher demand. Online platforms like Etsy, for example, have given artisans a global audience for their high-quality handmade goods. When people choose quality goods, they are choosing longevity over convenience, enduring craftsmanship over temporary trends, and often, a timeless aesthetic over what is in vogue today. For those on the outside looking in, the idea of acquiring an existing business might seem both enticing and overwhelming. When people buy second-hand items, they are extending the life cycle of those goods, which means fewer products end up in the trash. Whether it’s a vintage armchair, a gently used dining table, or a piece of mid-century modern furniture, second-hand furniture can be both functional and stylish. Overpricing an item can lead to it sitting unsold, while underpricing it can result in lost potential revenue. It’s a world where even personal growth, self-actualization, and emotional healing are framed as commodities, available for purchase at any time, but only if you’re willing to pay the price. Whether it’s a rare collectible, a discontinued item, or a vintage piece of clothing, online platforms offer a global marketplace where buyers and sellers can connect over products that may not be easily found elsewhere. They can assist in determining the right price for the business, marketing it to potential buyers, and managing the negotiation process. In addition to individual sales, online marketplaces often feature businesses and professional sellers who specialize in second-hand goods, providing buyers with a curated selection of high-quality items. A house can be bought, a car can be sold, a watch can be pawned. A car is something that can hold a great deal of sentimental value. On the other hand, traditional industries such as brick-and-mortar retail or manufacturing may face challenges, with many businesses in these sectors looking to sell or transition due to changing market conditions. When someone buys a second-hand item, whether it’s a piece of furniture passed down through generations or a retro jacket from a bygone era, they are not just acquiring an object; they are connecting to a story, a memory, or a cultural moment. The culture of buying second-hand goods is rapidly shifting in the modern world, particularly among younger generations.